What is Crypto Staking?

Crypto staking entails locking up one’s cryptocurrency holdings to earn interest or prizes. Staking is the process by which specific blockchain networks validate transactions.

Staking cryptocurrencies is a technique for investors to build their cryptocurrency holdings without buying more. Staking crypto for maximum passive income is a legal approach to increase the yields on one’s current crypto assets.

Investors that participate in staking get higher interest than they would in a traditional bank account. If you’re interested in staking cryptocurrencies but aren’t sure what it means, let me explain.

Before we go there, it’s essential to grasp what blockchain technology is all about.

Blockchain technology is used to create cryptocurrencies. Before the necessary data can be put on the blockchain, transactions using such currencies must be validated. Staking is the name for this validation method.

Let’s take a closer look at it.

There are no middlemen in blockchain networks since they are decentralized. This is in stark contrast to traditional financial systems, which rely on banks to serve as a storehouse for the public’s money, for example.

As a result, decentralization necessitates the creation of a publicly accessible network record to provide complete transparency and authenticity across all transactions. Transactions are organized into “blocks” and submitted for inclusion in this permanent record.

By the way, this is probably the most crucial security aspect of blockchains. It’s tough to deceive or hack because everything is visible and verifiable through a distributed public ledger (the record).

Users who possess these blocks will receive a transaction fee in the form of cryptocurrency once these blocks are accepted.

What role does staking play in all of this? You might inquire. Simply, staking serves as a precaution against possible errors and fraud during the process.

Whenever a user proposes a new block or votes to accept one that has already been offered, they risk losing some of their bitcoin. This procedure encourages people to follow the regulations.

In theory, the more crypto a user invests, the more likely they will collect transaction fee benefits. However, suppose a user’s proposed block contains fraudulent or tampered data. In that case, the stake they put up will be forfeited.

How does crypto staking work?

Staking cryptocurrency can be done in a variety of ways. To begin, you have the option of validating transactions on your computer.

You can even “assign” your crypto to someone you know and ask them to verify your identity. It’s worth noting that not all coins can be staked.

Continue reading to learn more about this topic.

What is proof-of-stake, and how does it work?

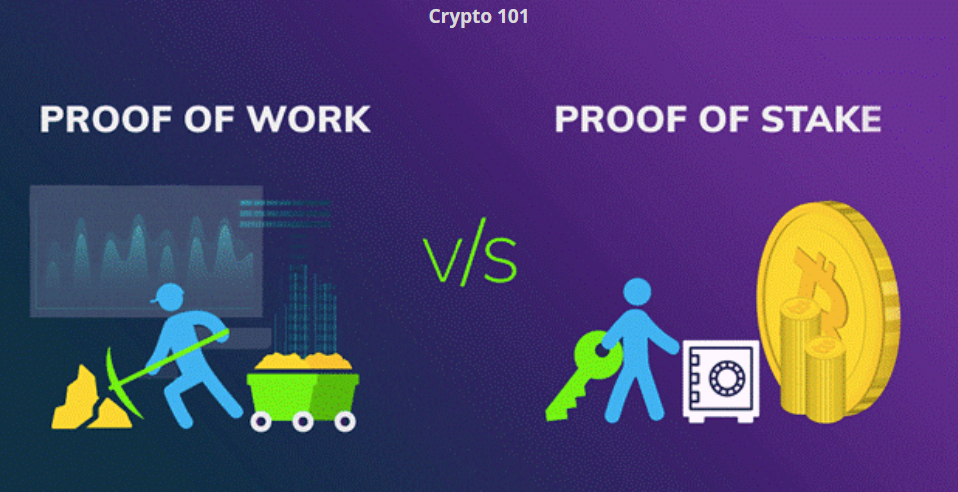

Proof-of-stake is a consensus technique for blockchains that allows transactions to be validated.

The number of coins (or stake) determines the probability of validating a new block in proof-of-stake (PoS).

PoS was established to replace the original proof-of-work consensus technique (PoW). PoS is a widespread consensus method gaining popularity due to its efficiency and the possibility of collecting crypto staking rewards.

PoS does not require as much computational work to validate transactions as PoW, which is particularly energy-intensive and requires a lot of CPU power. To validate blocks, currency owners “stake” their coins as collateral.

What are staking rewards?

Participants on the blockchain are given incentives called staking rewards. For validating transactions, each blockchain allocates a fixed quantity of crypto rewards.

As a result, when individuals that stake crypto is picked to validate transactions, they obtain staking incentives. Staking, in essence, allows users to earn more cryptocurrency.

Interest rates vary for every network, but participants can earn from 20% to 30% per year. Many people invest in cryptocurrency to earn passive income or diversify their portfolios.

Staking Cryptocurrency in Different Ways

To stake cryptocurrency, choose one that follows the proof-of-stake paradigm, such as Ethereum. Staking cryptocurrency can be done in a variety of ways:

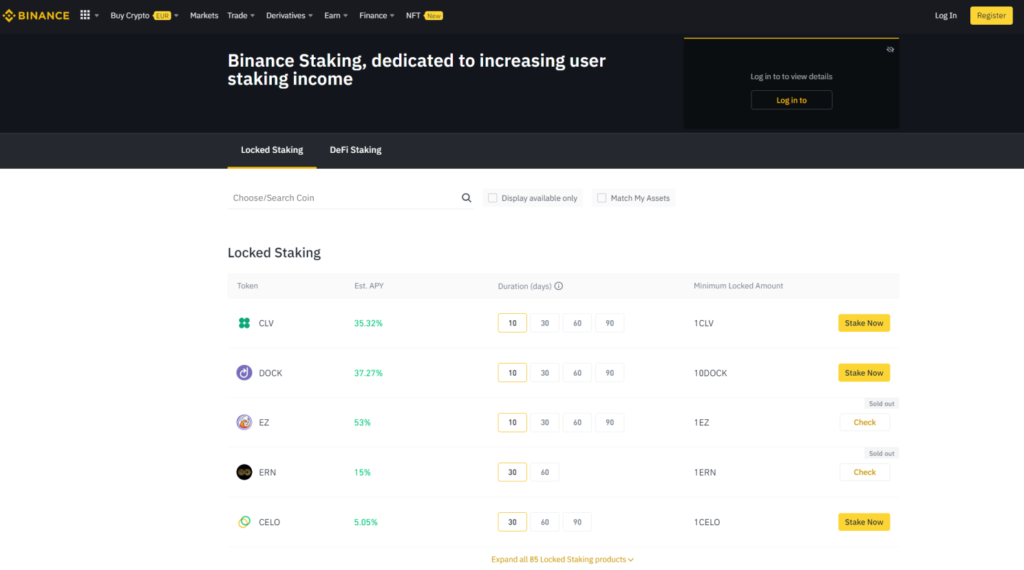

Through an exchange

You can choose to have your tokens staked on your behalf by using an exchange. An exchange is a type of online service that focuses on cryptocurrency. In exchange for staking services, most exchanges want a commission.

Binance, Coinbase, and eToro are some of the most prominent exchanges that allow you to stake.

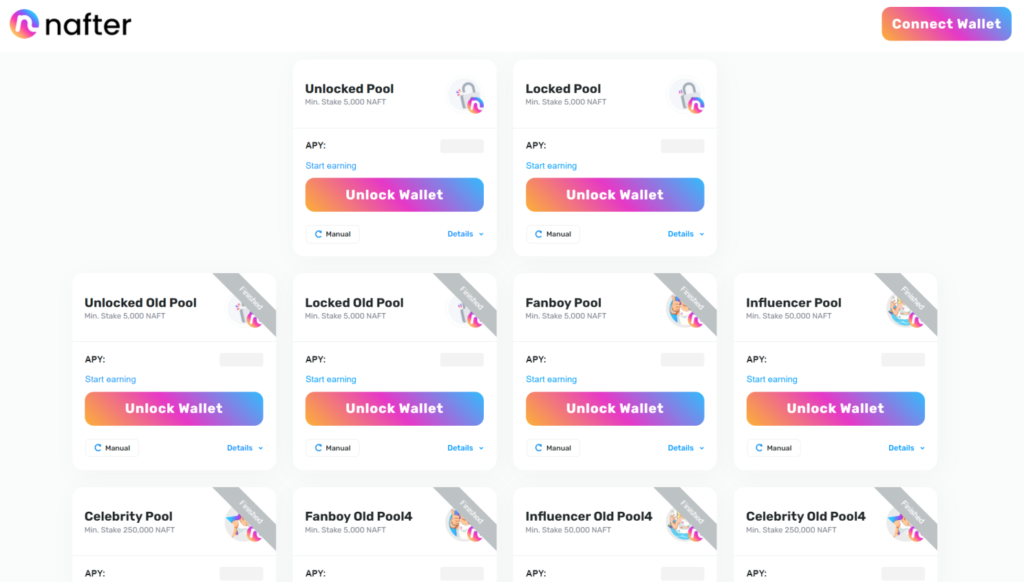

By becoming a member of a staking pool

Some investors avoid using exchanges since they do not support a diverse range of tokens. As a result, another option is to join a “staking pool,” which is often run by another user. Nafter is among the most popular staking pools.

You’ll need to link your tokens to the validator’s pool using your crypto wallet. Check the official websites of proof-of-stake blockchains to discover how they should operate to confirm the legitimacy of these validators.

As a validator

Validators are coin owners who have placed bets on their coins. To validate a block, they are chosen at random.

When employing a competition-based technique like proof-of-work, it’s the equivalent of mining.’ Naturally, becoming a validator yourself is one of the most effective ways to stake crypto.

Many validators validate blocks, and they are finalized and closed when a certain number of validators confirm that the block is correct. It is, however, more complex than using an exchange or joining a pool because it necessitates the creation of your own staking infrastructure.

You’ll need the proper hardware, including the computational power and software, as well as the ability to download the blockchain’s whole transaction history.

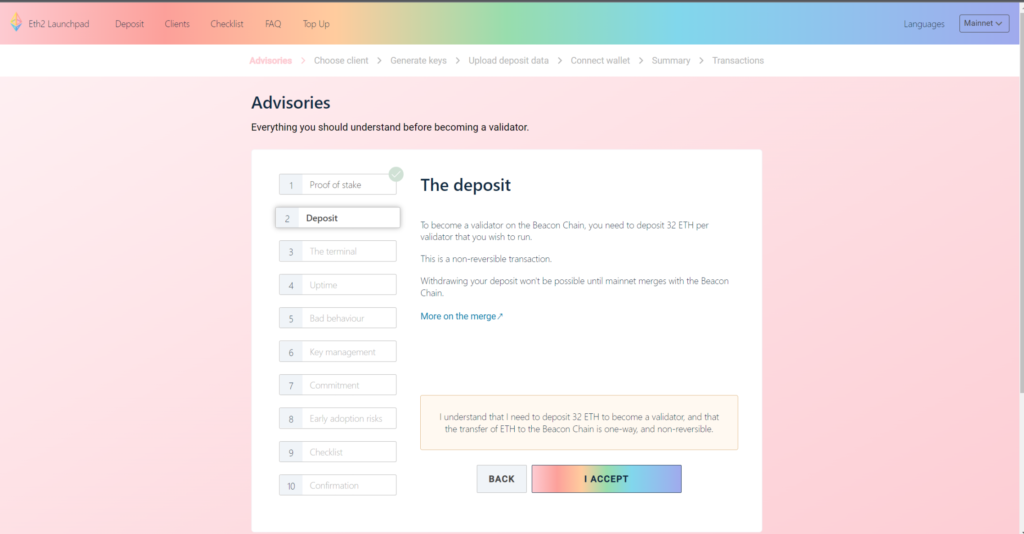

Becoming a validator usually comes with a hefty price tag. On the Ethereum network, a minimum of 32 Ether (ETH) is required, which roughly translates to $140,000, give or take.

Is staking crypto profitable?

So, the critical question is: How does staking cryptocurrency generate revenue?

To put it another way, let’s put it this way.

If you’re already familiar with crypto mining and trading, that’s a wonderful place to start. Staking may be just as rewarding as mining and trading but without the danger. Staking cryptocurrency is, thus, profitable.

Essentially, you must purchase and keep some coins before adding them to the mining pool. The amount of profit you make, usually in the form of transaction fees, is determined by how much you bet and how long you do it.

Consider these factors for improving your staking profit.

In general, when you increase your stake, you will make greater money. When it comes to growing your profits, there are a few important factors to consider:

- Value of a coin: Avoid staking a coin with extremely high inflation rates. You may receive large payouts at first, but due to the volatile nature of the coin’s value, you may end up with little to no profit.

- Fixed supply: Check if the token or coin has limited availability. The limited coin circulation maintains a robust demand and consistent price increase.

- Actual applications: The demand for a cryptocurrency is determined mainly by its actual applications. It will continue to have a strong demand and price if it is widely employed for numerous applications in the real world, such as digital payments.

Which cryptocurrency is the best to invest stake?

As previously stated, not every cryptocurrency is suitable for staking. Staking is not supported by Bitcoin (BTC) since it employs a different way of validating transactions: proof-of-work.

Staking may be possible if a cryptocurrency is linked to a blockchain that uses proof-of-stake as its incentive mechanism.

Ethereum

Ethereum, as one of the most prominent altcoins on the market today, provides significant staking profits. The average annual rate of return for staking Ethereum is between 5 and 17 per cent.

Cardano

Cardano, like Ethereum, is a smart-contract platform. The platform’s proof-of-stake network is powered by Cardano (ADA), a digital currency. Binance encourages ADA staking and pays up to 24% rewards.

EOS

EOS, like Ethereum, is also used to support decentralised programmes. EOS (EOS) can be staked to receive 3.2% rewards on average.

Cosmos

The ‘internet of blockchains,’ as Cosmos has been dubbed, Through interoperability, Cosmos allows different blockchains to transact with one another. Cosmos (ATOM) staking is supported by several platforms, including Coinbase, Kraken, and Binance. ATOM staking generates an annual return of 7% on average.

Tezos

Tezos (XTZ) is the native currency of the Tezos open-source network. XTZ can be purchased on various exchanges, including Kraken, Binance, and Coinbase. The current average yield for staking XTZ is 6%.

Polkadot

Polkadot, like Cosmos, promotes the interoperability of different blockchains. Some platforms, notably Kraken, Fearless, and Binance, enable Polkadot (DOT) staking despite its youth. The average annual yield for staking Polkadot is currently 12%.

Is it possible to lose money by staking cryptocurrency?

The first and most significant consideration is the level of risk involved when it comes to investing. Is it safe to stake cryptocurrency?

Yes, it is, but there are a few dangers to be aware of.

In general, you cannot “lose” money by staking cryptocurrency. Inflation and illiquidity, to mention a couple of items, are things to watch out for. Given how volatile cryptos are, there’s a potential the coin you’re staking will lose value.

For example, if you stake your cryptocurrency and it loses value despite earning returns from staking, you might theoretically lose money.

If you’re a day trader, you won’t be able to use the coins for several weeks or months, which means you’ll miss out on lucrative bets. This is why it’s critical to use caution while choosing which coins to stake.

Final Words

That’s it for the quick guide, I hope that my content added a bit value to your time. If you think any other explanation could’ve been added, feel free to use the comment section and generate awareness within our community.

Till then, you can follow me to stay updated with the trends and get an insight about the markets. There’s a lot more coming in the upcoming days so do SUBSCRIBE the newsletter.

If you liked the content, feel free to share it within our community and if you didn’t liked the content, do let me know that too. So I can improvise next time!

Stay Safe, Stay Healthy and Take care of yourself and your Loved Ones.