As the Indian government has decided to impose a flat 30% tax on crypto, the crypto community is positive. But with this, a lot of new investors are in their dreamy world of being quick rich.

So let’s cut the noise and start a practical approach on “How to retire with Cryptocurrencies?”

We all know that Cryptocurrency is a type of digital currencythat is currently decentralized, recorded, and kept on a blockchain system. Cryptocurrency is generally thought of as a way to get rich quick.

Since its inception in 2008, Bitcoin has spawned plenty of success tales of people who got in early, gained money, redeemed their gains, and retired on the backs of their profits.

Due to this successful story, most of us have been inspired to question, “Can I do the same?”. Is it possible to retire with Cryptocurrency? Yes, to put it simply. If you invest in cryptocurrencies, you can achieve financial independence.

Bitcoin, the most popular Cryptocurrency, returned 254,445%to investors between March 2012 and March 2020, equating to roughly 50,000 per year in passive income.

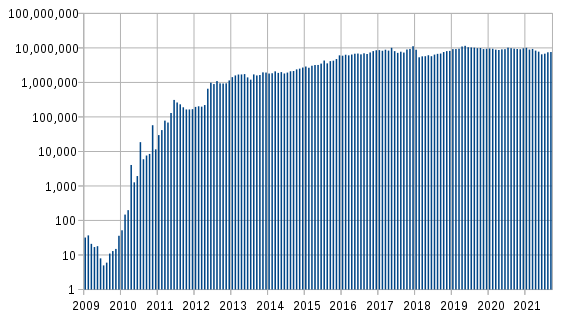

At the same time, the monthly number of Bitcoin transactions climbed by about 5,000 to 10,000,000. These figures demonstrate the significant volatility of cryptocurrencies. As a result, it may be inferred that Cryptocurrency can be used to retire.

Which are the most popular Cryptocurrencies?

Cryptocurrencies are ranked according to their market capitalization, calculated by multiplying the total number of shares in a currency by its price.

As a result, a cryptocurrency with more transactions may have a bigger market capitalization and value. The top ten cryptocurrencies, according to Nasdaq, are as follows:

- Bitcoin (BTC)

- Ethereum (ETH)

- Stellar (XLM)

- Binance Coin (BNB)

- Cardano (ADA)

- Dogecoin (DOGE)

- XRP (XRP)

- Litecoin (LTC)

- Bitcoin Cash (BCH)

- Chainlink (LINK)

Various other altcoins are still gaining popularity. As a result, picking the correct Cryptocurrency to invest in is critical. It would help if you also looked at the many charts and analytical reports available.

These provide a breakdown of the crypto asset’s performance and can assist you in determining its long-term potential. Many factors influence your final decision on which Cryptocurrency to use for retirement savings.

Factors that should affect your choice of Cryptocurrency:

- Ease of Access

Approaching a broker or opening an account on a stock trading platform can make investing in the stock market uncomplicated.

While you can easily register an account on a digital exchange to invest in crypto, the multistep account opening process will require comprehensive financial verification before you can access a wallet.

If you want to mine digital currencies like Bitcoin, on the other hand, you’ll require technical knowledge. The accessibility of different cryptocurrencies varies.

- Volatility

Volatility is both a cryptocurrency’s most vital and worst feature. Although cryptocurrencies have been around for a while, they are not as straightforward to use as traditional investment methods.

This simultaneously excites and scares investors into making a transaction. Because of this contradiction, bitcoin has a higher level of volatility than any other investment strategy, making it far more difficult to anticipate.

When you invest in cryptocurrencies, you should expect the value to change significantly. This means that your tiny investment could turn into a fortune or a dud. However, it has become increasingly difficult for anyone to predict your investment portfolio’s future worth in recent years.

- Potential for the future

While the number of Bitcoin exchanges per month has surged over the last decade (as indicated in the table below), it is still too early to say whether a cryptocurrency will completely replace paper money.. If this happens, the value of Cryptocurrency will rise.

If it doesn’t, though, you can expect it to grow more slowly. Any cryptocurrency’s long-term potential is yet unknown. Because you can’t invest in Bitcoin or any other cryptocurrency for the short term, volatility is a significant factor.

These three elements will have a long-term impact on the value of bitcoin. You should have a strategy in place if you want to retire with Cryptocurrency. We shall discuss all cryptocurrencies in general in this essay.

However, depending on which Cryptocurrency you choose, you may need to adjust your investment plan.

How to realistically retire with Cryptocurrency in 5 Years?

- Establish your budget.

The first step is to figure out how much money you’ll need each month. This should contain all expenses, such as groceries, needs, and recreational things. In the event of a medical emergency, it’s also a good idea to have a little emergency fund set aside. Assume you have a yearly budget of INR 500,000.

- Calculate how much money you’ll need to retire.

Your retirement savings and plan should be sufficient to support your current lifestyle. The standard way is to multiply annual expenditure by 25. As a result, based on the above figure, you’ll need INR 1.25 crore to maintain your lifestyle at the same standard of living. For INR 1.25 crore, you’ll need to withdraw at a pace of 4% each year to stay afloat.

However, this figure (25) presupposes that you retire at 60 and live to be 85 years old. You’ll need to increase this number if you want to retire early with crypto. If you retire at the age of 40, for example, you must multiply your annual expenses by 45.

- Collect the required amount

The next stage is to collect this sum of money. Only a few people have this much money in their bank accounts. You may need to cut back on your spending or raise your income to get this money. It’s a good idea to look into and use various sources of revenue.

You can save money more quickly if you eliminate any unnecessary expenditures. Rather than spending INR 250 on a daily coffee, invest in a coffee machine that will last you several years—making the replacement can save you up to INR 150 every day.

- Define your risk tolerance and assign a percentage to it.

In theory, the younger you are, the greater the amount of danger you can accept. However, this isn’t always the best course of action. Assessing your risk tolerance is an intelligent place to begin. It is not advisable to rely solely on bitcoin for retirement; consequently, diversification is advised. This might aid in the creation and management of your portfolio. Finally, after you’ve agreed on an investment %, you’ll be able to stick to it.

Conclusion

Regularly booking profits assures that you can maintain your position, and eventually, you can retire with cryptocurrencies. However, rather than focusing just on the benefits, the decision to do so should be based on the numerous risks associated with the investments.

Even though bitcoin has the capacity to develop, the market’s future remains uncertain. As a result, cryptocurrency investments should only be made after thorough research and knowledge of the values, benefits, and drawbacks. With proper study, you may retire with cryptocurrencies in your 20s, 30s, or even 40s.

Final Words

That’s it for the quick guide, I hope that my content added a bit value to your time. If you think any other explanation could’ve been added, feel free to use the comment section and generate awareness within our community.

Till then, you can follow me to stay updated with the trends and get an insight about the markets. There’s a lot more coming in the upcoming days so do SUBSCRIBE the newsletter.

If you liked the content, feel free to share it within our community and if you didn’t liked the content, do let me know that too. So I can improvise next time!

Stay Safe, Stay Healthy and Take care of yourself and your Loved Ones.